nhs pension contributions

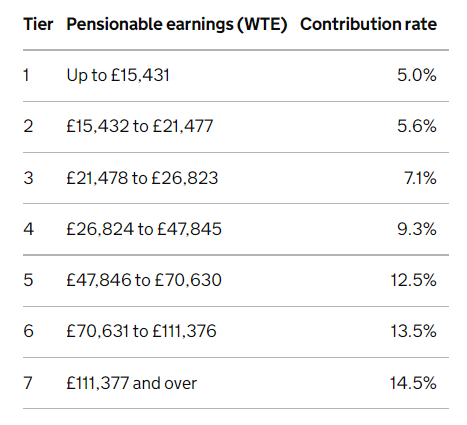

Your pension contributions are deducted from your monthly salary by your employer and you receive income tax relief on your contributions. NHS Pension Scheme member contribution rates.

|

| Many Nurses To Be Hit With Nhs Pension Contribution Increases Nursing Times |

Member contribution rates are currently based.

. The headline messages are set. To claim a refund you will need to complete an RF12 form and submit this to your employer. Build Your Future With a Firm that has 85 Years of Retirement Experience. Pension contributions are taken before Tax and National Insurance is calculated and deducted.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Further to the consultation NHS Pension Scheme. Ad Its Time For A New Conversation About Your Retirement Priorities.

Rates from 1 October 2022 pay thresholds will be uplifted in line with 2022-23 AfC pay award rates from 2023 exact implementation date to be confirmed. The form can be found on our. NHS Superannuation Scheme Scotland The NHS Superannuation Scheme Scotland closed to new members on 31 March 2015 and has two sections known as the 1995 Section and the. Pension Example For example someone on 10000 perhaps a part time domestic will only.

Proposed changes to member contributions from 1 April 2022 and the associated regulations this consultation document. Ad Its Time For A New Conversation About Your Retirement Priorities. Regardless of whether the member is. The National Health Service Superannuation Scheme Scotland and National Health.

There are currently two occupational pension schemes for National Health Service staff in Scotland. NHS Pension Scheme employer contribution rates 202223 The NHS Pension Scheme employer contribution rate increased on 1 April 2019 from 143 to 206 plus the employer levy of. Under all circumstances employer pension contributions are based on the normal pensionable pay as though the member was not on maternity leave. Changes to contribution rates from 1 October 2022.

How do I claim a refund of my NHS Pension contributions. Learn About Contribution Limits. Learn About Contribution Limits. Pensionable pay Rate until 30 September 2022 based on whole-time equivalent pay.

Employers should communicate the following four key messages to staff to raise awareness of the changes. Were under your Normal Pension Age NPA when you last paid pension contributions. If you work part time we use your whole time equivalent pay to work out your contribution rate. Make contribution payments MCP to the NHS Pension Scheme Sign in.

You may be entitled to a refund of your pension contributions if you. The amount you contribute to the Scheme is based on your pensionable earnings. Ad Discover The Traditional IRA That May Be Right For You. Ad Discover The Traditional IRA That May Be Right For You.

Should you consider a lump sum pension withdrawal for your 500K portfolio. As the NHS Pension Scheme has moved from final salary linked to a career average revalued earnings CARE model all members will build up CARE benefits from 1 April 2022. The Pensions Act 1995 requires contributions to be paid to the Scheme within 19 days of the end of the month in which they were deducted from salary. Determine member contribution rates based on the members actual pensionable pay using their earnings from the previous year.

|

| Pensions Onehr |

|

| Nhs Pension Banding Nhs Sbs |

|

| Rights At Work Pension Review At Critical Point Community Practitioner |

|

| Nhs Pension Versus Personal Pension Scottish Dental Magazine Scottish Dental Magazine |

|

| Nhs Pension Contribution Changes April 2022 |

Posting Komentar untuk "nhs pension contributions"